Global Paper Market Update:

Industry Trends, EUDR and the AI Bubble

4th December 2025

Written by Iwan Le Moine

As we approach the final weeks of the year, I wanted to share a few words relating to paper demand, both in Europe and further afield, highlighting the difficult situation for sellers and buyers, all the while touching on some important current issues facing the paper industry, such as EUDR & AI, but also as a wider phenomenon beyond our industry, bringing massive changes to societies as a whole.

EMGE 61st World Graphic Papers Forecast Report

We have just issued our latest EMGE World Graphic Papers forecast report, the 61st edition since it was first published in 1995, covering global demand for:

- Newsprint

- Uncoated Mechanical Papers / Supercalendered (SC) Magazine

- Coated Mechanical Papers / Lightweight Coated Paper (LWC)

- Uncoated Woodfree (incl. A3/A4)

- Coated Woodfree / Fine Papers

The Digital Transformation of the Paper Market

Computers/IT were still a slightly nerdy subject when we first published this report, and mobile phones were few and far between, let alone smart phones, still some ten years away; and we all read on paper a lot more!

How many of our children, or, if we have them, grandchildren even know what newspapers are?! How many magazine subscriptions do we now have in our households, from Rugby World & Yachting Monthly magazines to Readers Digest, or even just a simple TV guide?!

Who reads a publication at the doctor’s or dentist surgery anymore? Do you now order on a paper menu at the restaurant or use a QR code, and how many bills and bank statements does anyone receive in the post these days? And what about books (hard back or paperback)? Do we and our children read as many as once we did? And this (books) is probably the most resilient sector globally.

At least we still have fish & chips served up in paper, if no longer actual newspapers!

2025 Paper Market Performance: No “Crash,” but continued decline

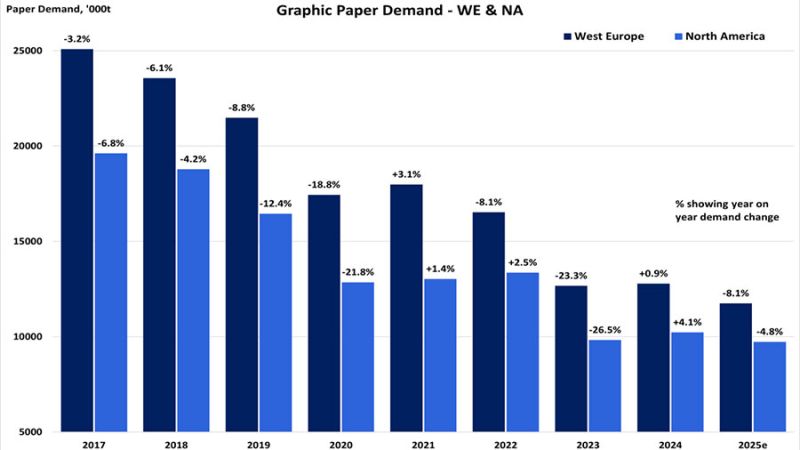

But all these changes have led us to where we are today, as well as to the growth rates we’ve become accustomed to in recent years, and once more in 2025, a year when there were no real “crash” moments to report, such as a banking crisis (2008-09), global pandemic (2020) or other economic bubble bursting.

More on this below, but for now, this is the demand growth for all paper grades this year (YTD):

| Paper Grade | W. Europe | N. America | Japan | World |

| Coated Woodfree | -9% | -10% | -2% | -6% |

| Uncoated Woodfree | -6% | -1% | -3% | -5% |

| Coated Mechanical/LWC | -11% | -7% | -1% | -6% |

| Uncoated Mechanical/SC | -12% | -6% | -3% | -8% |

| Printing & Writing Papers | -8.9% | -4.0% | -2.7% | -5.6% |

| Newsprint | -7% | -16% | -9% | -10% |

| Total Graphic Paper | -8.6% | -5.2% | -4.2% | -6.2% |

Permanent Demand Loss in the Paper Market

So, let’s take a brief look at what has happened in what were very dramatic recent years.

- COVID-19 and the associated lockdowns made huge headlines worldwide, and absolutely destroyed demand for Printing & Writing Papers and Newsprint – permanently. The rebound in 2021 regained little of the lost ground.

- 2023 Inflation: But what may surprise some people is that 2023 was worse. The inflation-driven price spike and supply shortages caused an even steeper drop in paper demand, and again, the loss was permanent, as the rebound in 2024 did little to rebalance the losses. So, after all the drama, demand last year was only half of what it was before COVID-19.

- Paper Market Current Status: And not only that, but we have (mostly) returned to something that looks like the old, pre-COVID rates of decline. Despite the occasional exception, the global picture is fairly clear, with the declines in Demand currently running somewhere between -5% and -10% year-on-year (i.e. roughly what we were seeing before COVID-19).

Paper Market Oversupply Crisis and Capacity Reductions

A major issue is the paper industry’s need to escape the current oversupply situation, which is getting quite dramatic in several sectors and regions. As a result, we expected the industry to respond by closing or converting capacity, but as more companies are now down to their last mill or machine in some paper sectors, we understand why those closures can be more difficult than they were in the past.

Having said that, businesses exist to make a profit, and we do not expect loss-making operations to continue for too long, hence the likelihood of capacity reductions to come. So, unless Demand returns to growth – and no-one realistically expects that – then the industry is in fairly urgent need of capacity reductions, to re-balance supply and demand.

- On the upside, some reductions have been announced, especially in Western Europe and North America.

- On the downside, based on plans announced so far, the global Graphic Paper industry will not get anywhere close to re-balancing supply and demand. Not at the global level and not even in Western Europe and North America, in most sectors.

Regional Focus: Uncoated Woodfree (UWF) in China

In China, the country continues to invest in UWF capacity, even after much of financially-troubled giant Chenming Paper’s idled capacity was re-started.

For long years, China has had a history of building huge amounts of new papermaking capacity, contributing to global overcapacity, resulting in closures of other mills – mostly in other regions. This first happened in the Newsprint and Coated Woodfree sectors, and in more recent years, it has been in UWF. One of China’s own largest UWF producers, Chenming Paper, is struggling hugely. With around three million tpa of capacity in UWF alone (not to mention other pulp, paper and board grades), the firm has been struggling with weak demand and making massive losses. One report suggested the firm lost around half a billion dollars in just half a year! A large volume of its papermaking capacity was idled, but we understand that some of it has come back on stream now.

The trouble is, China is still building more UWF capacity. More than two million tpa are being added just this year, to a market with Operating Ratios at around 70% (EMGE figure; estimates vary widely!)!

European Deforestation Regulation: Delays and knock-on effects

As we near the implementation date for the European Deforestation Regulation (EUDR), the EU parliament voted last week in favour of an amendment relating to the Regulation scope. There is now a proposal to exempt finished printed products, including newspapers, books and magazines, from the Regulation. They have also voted for a delay in implementation, simplified due diligence obligations, as well as a review of the simplification of the new Law by the end of April 2026. This will now go to the Council and the Commission for final adoption.

- Preparation Variables: Many companies are ready now. They do not need a delay from their side, because they have already done the hard work and spent the money to be ready in time. So a delay now does not benefit them at all, quite the opposite. Other companies are annoyed that the EU initially suggested an extra year, but then actually only firmly proposed this for the smallest companies, while larger firms would only get a six-month “grace” period.

- Legislative Gridlock: It may not even be possible to agree to the proposed new changes in time. We are only weeks away from the current due date for implementation of the EUDR. And the potential changes are so far only a proposal. Normally, it takes a certain amount of time for the European Council, Parliament and Commission to agree and approve such proposals. It is possible to fast-track it, but that normally requires the Parliament and Council to be in agreement with the proposal already. And they are not. All of which makes it look quite unlikely (to us, anyway) that the Commission’s proposal, let alone the Parliament’s amendment, will get over the line before the end of this year.

- The ‘Ridiculous’ Situation: So we have the somewhat ridiculous situation where companies may or may not need to start complying with the EUDR in its existing form in just a few weeks’ time, but they don’t know for sure if they will need to. This obviously leaves little or no time to plan for whatever is about to happen.

Furthermore, as many industry associations have pointed out, making new changes this close to the deadline, without really giving enough time to plan or get ready for them, is far from ideal. Although excluding finished printed products from the EUDR would certainly be very welcome news for some.

So, this proposal has left many stakeholders far from impressed.

For the larger companies that are already prepared, they could of course begin to comply from the end of this year, assuming it will be technically possible to do so. The problem with that is, they need either no new agreement or the Parliament’s new proposals to be agreed very soon. However, with the extremely short time available and a new, full-year delay being pushed by several parties, we believe an end-2026 deadline is now looking increasingly likely.

Whatever happens, it is going to upset someone, if not everyone!

Trump trouble / AI bubble?

We’re not quite sure what to make of the new Trump presidency. In decades of watching the USA since the 1970s, we have arguably never seen anything like this.

Are the constant slightly wild headlines aimed at distracting us from something we’re not seeing? Is this the strangest “deal making” ever? Is Trump just months away from being a “lame-duck” President again, or will the 2026 mid-term elections actually even happen in a recognisable way?

Our team is divided on this, and we honestly don’t know what to expect. Is the USA heading for some sort of historic change, or is this all just noise and nothing actually to worry about? Although we are not at all confident of predicting what is going to happen in this regard, we don’t see many potential positives for our forecasts.

The Fragility of US Growth and The AI Factor

Meanwhile, concern is growing over the fragility of US economic growth, which is unusually reliant on a single sector. One report suggested that AI infrastructure spending accounts for 40% of US economic activity. To some extent, this is propping up an otherwise rather lacklustre US economy. The problem is, there is no sign of AI as an end product getting anywhere near profitability any time soon, to justify what are absolutely colossal investments.

- OpenAI, for example, is expected to invest US$1.4 TRILLION in AI infrastructure over the next eight years. But it only has US$13 billion in annual revenues. And it lost almost that much last quarter. One wonders where the profits are expected to come from – and when.

- Nvidia: At the same time, chip firm Nvidia is currently trading at a value that makes it worth more than any country’s economy, except China or the USA. So – in value terms, Nvidia is seen as being bigger than Japan or Germany. Nvidia also recently bought a stake in OpenAI and OpenAI used that money to buy Nvidia chips. So to some extent, Nvidia is indirectly buying its own product, by investing in its heavily loss-making customer.

This is far from being the only example of the industry cross-investing, and there are reports of some of the actors disguising their investments, to make their profits look better than they really are. All of which is causing some observers to worry that we are looking at another bubble that has to burst sometime. And of course, there are the social and environmental costs. The server farms being built to provide the huge amounts of computing power that AI needs are consuming so much energy that electricity prices are rising in some regions of the USA. Not to mention emissions, etc.

Despite all of this, Consensus Economists are generally pretty rosy about general global macro-economic conditions next year, as these have been improving month on month since a low in May/June. Quite surprising really, given some of the above! This article was first posted on LinkedIn here.

Free Sample

Latest industry trends!

Sign up to receive paper industry insights and the latest news straight to your inbox.

Includes a FREE sample report